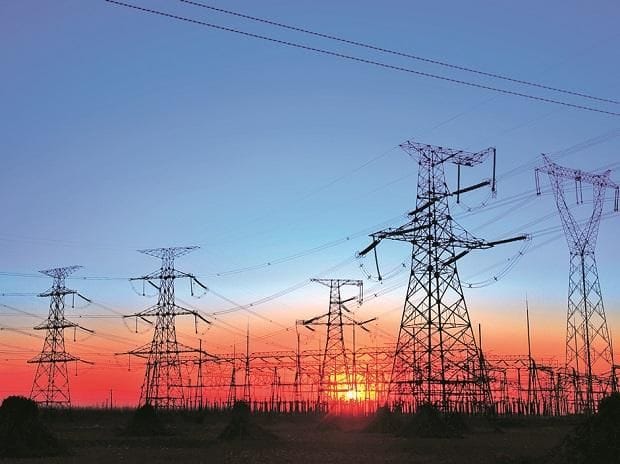

On August 6, 2025, the Supreme Court addressed the governance of the regulatory assets established by power distribution companies, in scenarios where tariffs simply do not allow companies to recover their costs. Regulatory assets were established to permit deferred recovery of costs, and to protect the consumer from abrupt tariff increases from a distribution company in particular, but these regulatory assets must have limits. The Court examined the regulatory framework established under the Electricity Act, the National Tariff Policies, the formal introduction of Rule 23, 2024, and all related rules and regulations.

The Court noted that regulatory assets in Delhi exceeded Rs. 27,000 crores due to ongoing revenue gaps due to under-recovery of tariffs, delays in subsidies in some situations, and new costs or rate increases in power purchase costs which was to the detriment of the financial viability of utilities and the impact of consumers. The Court stated that regulatory assets are not entitlements that are created by statute and are simply the management mechanisms which must adhere to legislative limitations.

The Court held that tariffs should be cost reflective with as little gap allowed as possible except for naturally occurring disasters in which the maximum cap remains 3% of the annual revenue requirement and any gap must be amortized appropriately: newly regulated assets should be amortized in three years; and, regular regulatory assets should be amortized in seven years. Regulatory Commissions must also fully audit the process and monitor as Regulators, meaning the principles must fully occur in real time to ensure audit compliance and accountability while reasonably maintaining transparency and financial propriety.

For More Updates & Regular Notes, Join Our

WhatsApp Group

and

Telegram Group.

Contact us at

contact@legalmaestros.com.

The principle that accountability was apparent was the determination by the Court that Regulatory Commissions should be accountable for their failure to mitigate the impacts of tariff shocks or financial instability and the Court termed these occurrences “regulatory failures”. In terms of abuse of discretion and accountability overall, the Appellate Tribunal for Electricity (APTEL) will be critical for Compliance monitoring and to be accountable for binding directions for next compliant step and other regulated, binding tariff fixings and liquidation.

The ruling ultimately reinforced the critical independence, efficiency and accountability of regulating and governing electricity to achieve the balance of (cost effective) consumer protection and viable corporations and more importantly the viability and sustainability and fairness of the electricity sector, whilst providing a coherent framework for state-regulator accountability invoke doctrinally and operationally to mitigate unavoidable revenue gaps to in fact provide bill payers a compliant tariff regime in the public interest.

For any queries or to publish an article or post on our platform, please email us at contact@legalmaestros.com.