The Supreme Court of India on the 22 nd of April 2025 observed the evidential value of the presumptions provided in Sections 118(a) and 139 of the Negotiable Instruments act 1881 in a case that involved N. Vijay Kumar v. Vishwanath Rao N in criminal appeal no. 5305 of 2024.

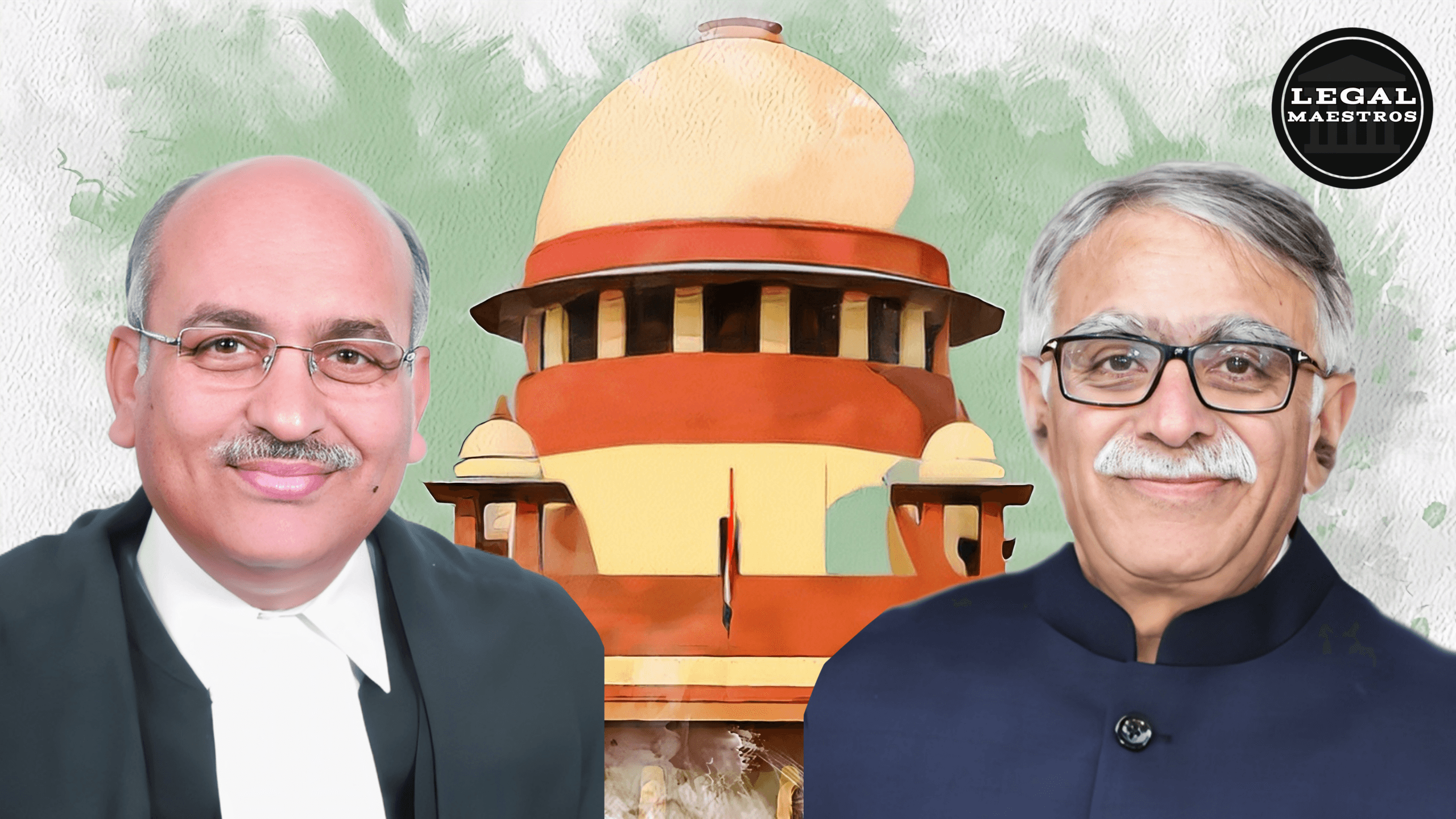

The two judges by the bench who happened to be Justices Sanjay Karol and Pankaj Mithal emphasized on the significance of demonstrating the legality of a debt in case a check is bounced.They found in favor of the accused and reinstated his acquittal.

A Quick Look at the Case

N. Vijay Kumar, the person who is appealing, and Vishwanath Rao, the one who is complaining, were friends for more than ten years. The person who made the complaint said that they had lent the accused ₹20 lakhs to assist pay for the making of the Kannada movie Indian Police History. On the 14 th of October 2008, the accused was able to write a check.

It was not honored on the 20 th of October 2008 with the note (Refer to Drawer) meaning that the money was not sufficient.

After sending the notice, the complainant approached the court using Section138 of Negotiable Instruments Act. The accused added that they could not be held liable because only the check was offered as security to a significantly smaller loan sum of 3.5 lakhs which had earlier been repaid through a Memorandum of understanding (MoU) dated 29 march 2008.

He said that two blank checks were given as security and that one was utilized in the wrong way following the supposed settlement.

The trial court found the accused not guilty because he was able to effectively challenge the presumptions in Sections 118 and 139 of the Act. The High Court, however, found the accused guilty on appeal and ordered him to pay ₹22 lakhs or go to jail. People took this decision to the Supreme Court.

Looked at the Statutory Provisions

The main parts of the case that were looked at were:

- Section 138 punishes anyone who don’t honor a check that was written to pay off a legally binding debt or obligation.

- Section 139: Assumes that the check was written to pay off that debt or obligation.

- Section 118(a) assumes that the negotiable document was drafted for a reason.

The Supreme Court also looked at a number of past decisions that helped establish these presumptions. These included the important case of Rangappa v. Sri Mohan and others like Kumar Exports v. Sharma Carpets and Basalingappa v. Mudibasappa.

The main legal issue

The main question was whether the defendant had shown that the check was not issued to pay off a legally enforceable obligation, and if so, whether the High Court was right to overturn the acquittal.

Assumptions and How to Disprove Them

The Supreme Court said that once a check is cashed, Section 139 creates the assumption that it was given to pay off a debt. This assumption may be challenged, however, and the accused does not have to establish beyond a reasonable doubt that the debt does not exist. It is enough for the accused to establish a likely defense, which might be based on the balance of probability or the facts that came up during the complainant’s own testimony.

In this instance, the accused gave a lot of circumstantial evidence:

- The check was a way to protect a smaller, older debt.

- The MoU that both sides signed said that the entire amount of ₹5.5 lakhs will be made.

- In July 2008, a police report was made about the two blank checks that had been lost.

- The complainant’s motives were even more suspicious since they presented the check for cashing many months after the police report.

- The Court decided that these facts cast a lot of doubt on the complainant’s argument and successfully disproved the legal assumption.

Looking at the Complainant’s Evidence

The Court said that the complainant’s proof wasn’t enough and didn’t make sense. He didn’t make:

- Proof in the form of documents or records of the supposed ₹20 lakh loan.

- Documents that show income tax or bank documents that show this kind of transaction.

- Independent witnesses, on the other hand, say they saw the check being given to them.

- His cross-examination also showed inconsistencies, such the fact that there were no receipts or records of the many loans that the accused had made.

The Supreme Court said that after the accused had rebutted the assumption, the burden of proof moved back to the complainant, who did not show the loan and culpability beyond a reasonable doubt.

What the MoU Does

The MoU from March 29, 2008, was very important. It was evident that the loan was ₹3.5 lakhs and that the person who borrowed the money had paid back ₹5.5 lakhs, including interest. This MoU made the complainant’s allegation of a ₹20 lakh loan much weaker and the accused’s story much stronger. The MoU also said that the complainant had returned the blank checks, which they said they still had.

The Court said that the complainant could not persuasively prove that the MoU was not real or contest its validity, and he did not explain how his accusations were different from what the agreement said.

What the Supreme Court found

The Supreme Court made it clear that to be convicted of a crime under Section 138, you must strictly follow both the law and the basic rules of criminal law. It said that:

- The accused had effectively met the burden of proving that the assumption was wrong under Sections 118 and 139.

- The person who filed the complaint did not show that there was a debt that could be enforced by law.

- The High Court made a mistake when it overturned the Trial Court’s well-reasoned acquittal.

- Because of this, the Supreme Court threw out the High Court’s decision and reinstated the acquittal.

Justices Sanjay Karol and Pankaj Mithal’s decision is an important reaffirmation of the legal principles that apply to situations of check dishonour. It makes it clear that statutory presumptions help complainants, but they don’t prove anything.

The accused may fight back with circumstantial evidence and doesn’t have to prove their innocence beyond a reasonable doubt.

The case shows how important it is to have written documentation in money disputes and that using security checks in the wrong way can’t lead to criminal charges unless there is clear and persuasive proof of a legally enforceable debt.

The Court has strengthened the principle of fairness and balance in cheque bounce cases under the N.I. Act by restoring the acquittal.

For any queries or to publish an article or post on our platform, please email us at contact@legalmaestros.com.

1 thought on “Acquittal Reinstated in Cheque Dishonour Case: Justices Sanjay Karol and Pankaj Mithal Clarify Presumptions under the Negotiable Instruments Act”