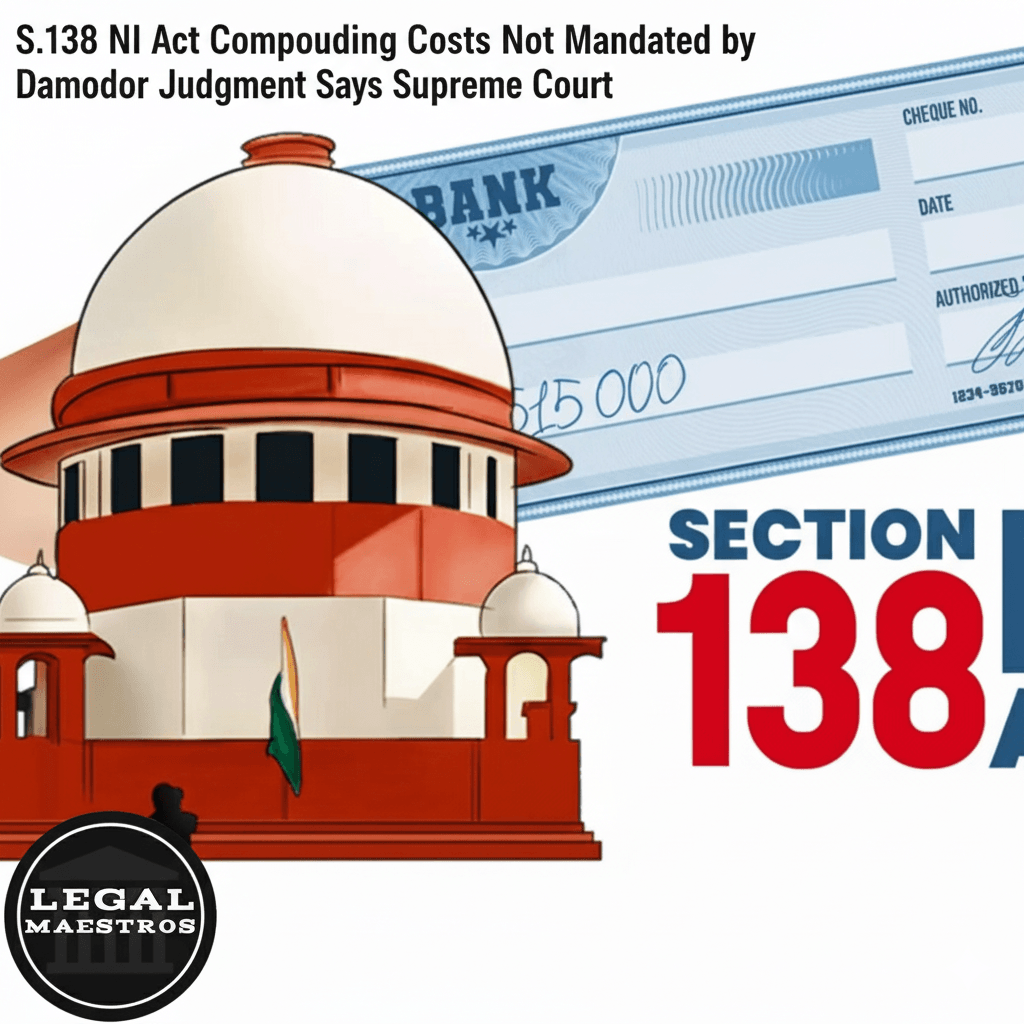

S.138 NI Act Compounding Costs Not Mandated by Damodar Prabhu Judgment Says Supreme Court

The Bounce Cases of Cheque in India.

In India, millions of court cases are associated with one thing, namely bounced cheques. Section 138 of the Negotiable Instruments Act (NI Act) deals with this. Simply stated, it is a criminal act to write a cheque that is disgraced by the bank because of lack of funds. The law was established so as to establish confidence in business transactions and to ensure that a cheque would be considered a promise with serious allegations to pay.

These are quasi-criminal cases which is a combination of both civil and criminal law. The accused person can be subjected to jail time but the primary aim of the person who was at the receiving end of cheque (the complainant) is not to see the other person in jail. They are mostly interested in reclaiming the money that they are owed. Due to it, the law permits the compounding of the offense, which is a legal term of a settlement.

In the case of compounding, the accused individual pays the cheque value and in other times a mutually agreed compensation to the complainant. The complainant in turn pledges to dismiss the criminal charges and the case is closed. The courts promote this process since it not only serves to bring justice to the complainant but equally, it serves to decongest the Indian judicial system which is overly loaded with cases.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

Over the years, the procedure of compounding was not that complicated. Nevertheless, the courts realized that most of the accused individuals would put off the case to last years just to promise to settle it at the very last minute, like when they were on the verge of conviction. This was delay of justice to the complainant and wastage of valuable time of the court. The Supreme Court intervened to resolve this issue by making a landmark ruling in 2010.

The Original Regulation: The Damodar Prabhu Judgment.

In 2010, a case named Damodar S. Prabhu v. was a historic case. The Supreme Court ruled that it would establish a mechanism to deter these delays (Sayed Babalal H.). The court hoped that they would provide the accused with a good financial incentive to resolve the case out of court. It established a graduated version of fees that a would-be settlee would have to pay, not to the complainant, but to the legal services authority, to settle.

These charges were charged as a percentage of the amount of bounced cheque. In case the accused has made an offer to settle at the very outset of the trial in the Magistrates court the fee was 10% of the cheque amount. They were to pay 15% more money in case they took the time of making the decision to settle the case after it had been submitted to the High Court during an appeal. In case the case was brought into the Supreme Court, the expense would be 20 percent.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

The reasoning was quite easy: the later you settle the more you pay. Such a decision was interpreted as a means of pushing to expeditious settlements and a serious deterrent to protracted litigation. These guidelines were utilized by courts in India, both lowest Magistrate court, and the High Courts, over a decade in practice, usually as an obligatory rule that should be obeyed.

This formed one of the regular practices where even when the complainant and the accused had agreed wholly to settle the case, the judge would still impose this extra 10 or 15 percent cost on the accused. Although the idea behind this was good, this strict implementation of the rule started generating other problems that were not initially anticipated during the ruling.

A Problem with the Rigid Rule

The extreme enforcement of the Damodar Prabhu costs began to produce a new obstacle to justice. Even in most instances, an alleged individual may be financially lucky enough to compensate the entire cheque value to the complainant. They could have been able to pool the money to restore the victim and put an end to the conflict. They just did not have the additional 10 percent or 15 percent of money to pay to the legal services authority as an additional expense, however.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

It resulted in a problematic scenario. The complainant was glad to finally get their money back and to put an end to the case and had no other option but to resume the legal battle. The case could not be closed by the accused who was ready to pay. The court would issue a ruling that would kill the settlement, not due to disagreement among the parties, but as a result of the extra price that the court would charge as a rule.

Such rigidity contradicted the actual intention of the Section 138, which is to make sure that the complainant receives payment. It was also contrary to the purpose of compounding that aims at decreasing the workload of the courts. Rather a case that would have been settled was pushed to a full trial, appeal and revision since the accused was unable to afford the extra cost known as the compounding cost.

This problem started to attract the attention of judges at the level of the High Court. They would in certain cases, waive the costs by use of their special powers, although there was legal doubt. It was realized that the guidelines of the Damodar Prabhu that were meant to be a solution was at times becoming part of the problem.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

The new explanation Costs are not compulsory.

Upon the realization of this issue, the Supreme Court has now made one of the biggest clarifications that will transform the cheque bounce settlement. In a recent decision, a court has decided that the expenses as presented in the Damodar S. Prabhu case are not some of the obligatory, binding regulations. Neither are they a straitjacket formula that all courts have to utilize in each and every case.

The Supreme Court has stressed the fact that the 2010 ruling was not to be a strict law but rather a guideline. The new ruling places the judicial discretion through the judges. This implies that, a judge listening to a case involving bounced cheques can now examine the case facts to determine whether the additional cost should be imposed or not.