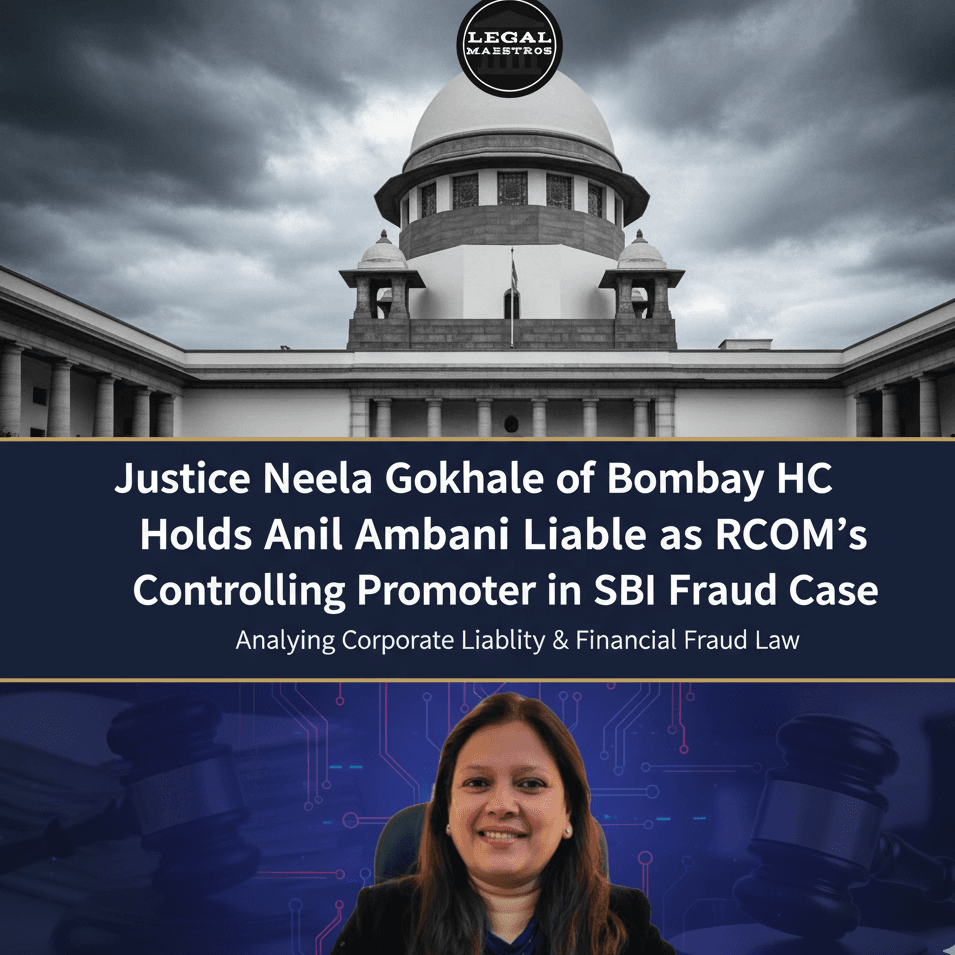

Justice Neela Gokhale of Bombay HC Holds Anil Ambani Liable as RCOM's Controlling Promoter in SBI Fraud Case

A Landmark Ruling: The Corporate Veil is Questioned

This is a dramatic move in a high profile corporate lawsuit where the Bombay high court has issued a decision that has a potential far-reaching implications towards the responsibility of the promoters of companies in India. Justice Neela Gokhale has decided that Anil Ambani, a former chairman in his role as a industrialist, was the controlling promoter of the former insolvent Reliance communications (RCOM). This discovery is a critical aspect of an open case of fraudulent claims over a huge loan granted by the State Bank of India (SBI).

The ruling goes right to the core of the principle of separate legal identity where a company is considered as an independent entity in comparison with its owners and directors. Through a special identifying factor on the controlling mind of the company, the court has created an avenue of potentially targeting the actions of the company to be directly linked with Ambani. It is a critical step in the legal history of the downfall of RCOM, a telecommunications giant at one point in the Indian market.

The case is also under close observation in the corporate world because it is pushing the limits of the role of a promoter. The decision does not decide on the ultimate verdict of guilty but lays a groundwork that the said fraud charges may continue. It answers the basic question as to who was really in control at the time of alleged financial misconduct and going beyond titles and designations takes a look at the actual performance of authority within the corporate setup.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

In the case of the State Bank of India, this observation by the High Court is a significant boost to its long and tedious struggle to reclaim huge amounts of money in the hands of the people. The complaint which is filed against the bank claims that the company has been committing fraud, and through this decision, the bank will be better placed to seek the individuals whom it thinks were the masterminds behind the company as opposed to operating the corporate corpse of a bankrupt company.

The Heart of the Matter: The SBI Fraud Allegation

The case in court is a result of massive loans, in thousands of crores, which the State Bank of India had given to Reliance Communications and its affiliate, Reliance Telecom. Having gone bankrupt, RCOM, SBI began to recover its dues. In the process, the bank had made allegations that it had found evidence of fraudulent activities in the account of the company and thus declared the account as fraudulent.

The essence of the complaint made by SBI is that the money lent to conduct certain business activities was not utilized properly and could be stolen. These accusations are highly grave because they imply that the management of the company intentionally falsified and wasted the state funds. A classification of fraud also will help the bank to institute more serious action which will include pursuing legal action against the people who controlled the affairs of the company.

It is not just the instance where a business defaulted in paying a loan because of the situation in the market; the charges against fraud suggest intentional misrepresentation. The lenders usually do forensic audits in such cases to determine the flow of money. It is based on such an audit that SBI probably decided to assert the account as a fraud, which was a necessary step before it could legally subject the promoters of the company to personal responsibility.

The easy reason why the bank is pursuing Anil Ambani is that such a massive operation, which entails huge amounts of money, could not have been implemented without the knowledge and guidance of the individual in ultimate control. The case proceeds are therefore aimed at proving that Ambani was not merely a figurehead chairman but participated in the day to day decision making that culminated in the purported fraud.

Piercing the Veil: The “Controlling Promoter” Finding

The most important part of this ruling is the decision of Justice Neela Gokhale that Anil Ambani was a controlling promoter. In corporate law the so-called corporate veil is a term of law that helps separate the actions and liabilities of a company (business) and its owners (shareholders) and promoters. This implies that when a company becomes indebted or sued the debt is normally restricted to the assets of the company and not the personal assets of the owners.

Courts may, however, lift the veil of incorporation under extreme cases and the most notable situation in which veil is lifted is where there is a fraud case. In case one can demonstrate that the company was just a mask behind which one person commits a fraud, the court may ignore the principle of the separate entity and make the persons behind the company personally answer. The ruling of Justice Gokhale practically preconditions such a possibility in the case.

The legal team of Anil Ambani had claimed that, he was not the daily management but rather a non-executive chairman and not part of the financial decision making of RCOM. They wanted to make him not connected to the alleged crime by focusing on this official title. The court however did not consider the title and based on what real power he had, and it was concluded based on the fact that he was the promoter and the face of the Reliance Group that his power and control was unconditional.

Such legal interpretation is giving a serious caution to promoters in India. It is an indication that being a non-executive does not necessarily mean that one cannot be found liable in case of a fraud. Courts are now eager to look into the content of control instead of the merely the form so that the people who genuinely take the advantage and control the actions of a company should be called to question in case they fail.

Although the decision of the Bombay High Court is a big blow to Anil Ambani, it is by no chance the final stage of the lawful procedure. This ruling is on the initial phases of the fraud case and the trial on the merits of the fraud charge is not yet conducted. The legal department of Ambani will appeal to this order and is likely to further fight to ensure that he does not have any personal interest in the financial operations of the company.