One of the most important questions in the field of tax administration was answered by the landmark case State of Rajasthan & Ors. v. Combined Traders (Civil Appeal No. 1208 of 2025) of the Supreme Court of India. The subject was whether or not a state government may rescind declarations that were made under a central act.

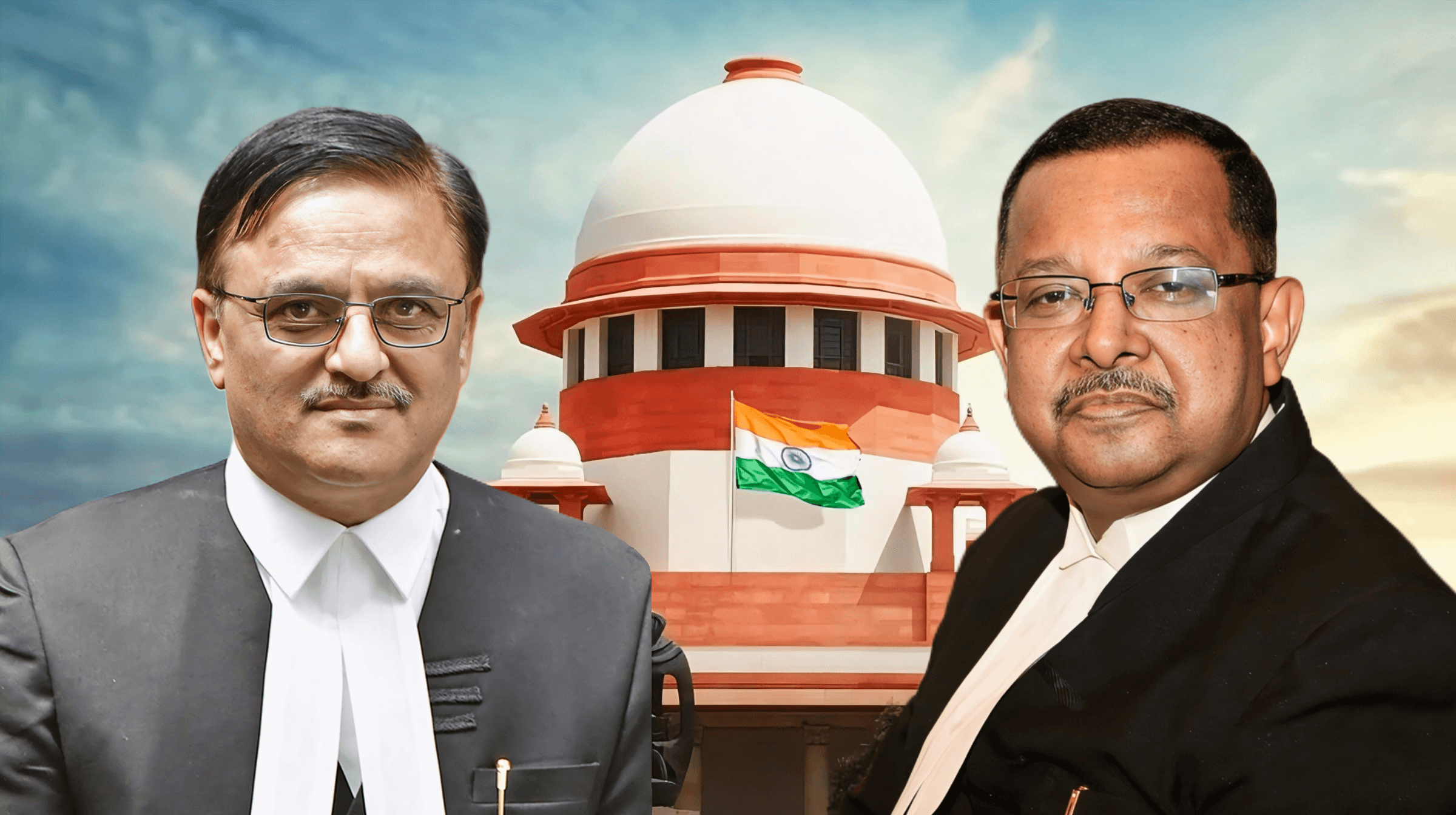

The Supreme Court of India, in a decision that was handed down by Justices Abhay S. Oka and Ujjal Bhuyan, came to the conclusion that the sub-rule (20) of Rule 17 of the Rajasthan Sales Tax Rules was beyond the scope of the court’s authority.

Under the Central Sales Tax Act of 1956, this case addressed the disagreement that existed between the tax regulations of the state and the central government, specifically in reference to Form C, which is a statement that is used to seek concessional tax rates in commercial transactions between states.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

Details on the situation

During the fiscal year 2017-2018, the respondent, Combined Traders, made sales to two companies, M/s H.G. International and M/s Saraswati Enterprises, that totaled many crores in value. In accordance with Section 8(1) of the CST Act, these sales were conducted against Form C in order to obtain concessional tax rates. After further investigation, it was discovered that the two purchasing companies were both fraudulent and non-functional. Following this, the tax authorities in Rajasthan canceled their registration and annulled their Form C declarations in accordance with sub-rule (20) of Rule 17 of the Rajasthan Rules.

Combined Traders filed a challenge against this action with the High Court of Rajasthan against it. When it came to the cancellation of Form C declarations, which are controlled by Central legislation, the High Court decided that the State of Rajasthan did not have the jurisdiction to create a regulation that allowed for the cancellation of such statements. The State filed an appeal with the Supreme Court about the ruling.

The underlying legal problem

One of the most important questions that needed to be answered was whether or whether a state government could, within the scope of its authority to make rules, include a provision similar to Rule 17(20), which would enable state tax authorities to revoke Form C statements. During the year 2014, the provision was implemented with the purpose of denying sellers tax advantages in the event that it was discovered that the purchasing party was either fraudulent or non-existent. In accordance with the Central Sales Tax Act, the Supreme Court was tasked with determining whether or not this sub-rule was legitimate.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

An Understanding of the Provisions of the Law

A dealer is eligible to pay a lower rate of tax on inter-state transactions in accordance with Section 8(1) of the CST Act if the acquiring dealer provides a valid declaration in Form C. This is the case if the dealer is buying the item. Due to the provisions of Section 8(4), the filing of this form is a prerequisite for receiving concessional treatment. It is important to note that the CST Act does not include any provisions that allow for the revocation of a Form C once it has been issued.

The authority to prescribe regulations is outlined in Section 13 of the CST Act. The only government that has the authority to regulate the structure and specifics of the declarations that are required by the Act is the Central Government, as stated in Section 13(1)(d). And this includes the C form. This authority has been exercised by the Central Government under the Central Sales Tax (Registration and Turnover) Rules, which were enacted in 1957. Form C and its application are both defined in Rule 12(1) of these Central Rules; nevertheless, the rule does not provide a provision for its cancelation.

According to Section 13(3), the states are permitted to formulate regulations in order to carry out the objectives of the CST Act; however, these rules must not be in conflict with the laws of the central government. In addition, Section 13(4) outlines particular domains in which states have the ability to establish regulations, such as the rules governing dealer registration and inspection; nevertheless, it does not include the authority to revoke Form C.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

The reasoning of the Supreme Court

The court determined that the government of Rajasthan had beyond the scope of its legitimate power. The CST Act and the Central Rules did not include an authority to cancel Form C; nonetheless, Rule 17’s sub-rule (20) established a procedure for doing so, despite the fact that such a power was not provided. By acting in this manner, it was in direct opposition to the Central framework, which was a violation of the plan of Section 13.

Once the Central Government had established rules on a particular topic, the Court emphasized that the State could not develop rules that were inconsistent with one another or that overlapped under the same act for the same matter. It is the exclusive responsibility of Central Rules to determine the format and treatment of Form C, which is a centrally created document. Because of this, the Rajasthan Rule encroached over territory that was formerly allocated for the Union.

In its earlier decision in State of Madras v. R. Nand Lal & Co., the Supreme Court said that regulations imposed by a state under the CST Act must not contradict the Central regulations. The Court relied to this decision when it announced its latest ruling. Additionally, a state rule that attempted to restrict the amount of transactions that might be included in a single Form C statement was invalidated as a result of this ruling.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

Result of the Investigation

The ruling that was handed down by the Rajasthan High Court was affirmed by the Supreme Court. Rule 17(20) of the Rajasthan Sales Tax Rules was found to be in contradictory to both the Central Sales Tax Act and the Central Sales Tax (Registration and Turnover) Rules, according to the decision. As a result, it was deemed to be unconstitutional and well beyond it.

In spite of the fact that the purchasing dealers were later shown to be fraudulent, the appeal that was submitted by the state of Rajasthan was rejected, which resulted in the affirmation of the rights of dealers such as Combined Traders who had relied on legal Form C statements.

Regarding the Importance of the Decision

Because of this verdict, the integrity of the federal framework in taxes is protected. It restates that states are not permitted to use their powers in areas that are solely within the jurisdiction of the central government. In addition to this, it makes it very clear that the rule-making authority of states, as outlined in the CST Act, is severely restricted and cannot be used to overturn or contradict Central Rules.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

In addition, the ruling provides relief to honest dealers who, in the absence of this decision, may have suffered as a result of fraudulent acts by purchasers. Within the frameworks of the Goods and Services Tax (GST) and the Value-Added Tax (VAT), the verdict also highlights the significance of due process and statutory interpretation in the maintenance of the rule of law.

Using this decision, the Supreme Court was able to shed light on a matter that had been lingering for a long time about Form C in the context of interstate trade. Through the elimination of the State Rule that permitted the cancellation of Form C in a unilateral manner, it was possible to maintain the homogeneity of the Central Sales Tax system. When it comes to legislation or drafting rules under a Central Act, this decision reaffirms the idea that state governments are required to conform their actions to the constitutional bounds that have been established by Parliament.

An important precedent in tax jurisprudence will be established by the case of State of Rajasthan v. Combined Traders. This precedent will be particularly useful in understanding the delicate balance that exists between the powers of the Central government and those of the states in India’s fiscal federalism.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

![Research Assistantship @ Sahibnoor Singh Sindhu, [Remote; Stipend of Rs. 7.5k; Dec 2025 & Jan 2026]: Apply by Nov 14, 2025!](https://legalmaestros.com/wp-content/uploads/2025/11/Gemini_Generated_Image_s0k4u6s0k4u6s0k4-768x707.png)

![Karanjawala & Co Hiring Freshers for Legal Counsel [Immediate Joining; Full Time Position in Delhi]: Apply Now!](https://legalmaestros.com/wp-content/uploads/2025/11/Gemini_Generated_Image_52f8mg52f8mg52f8-768x711.png)