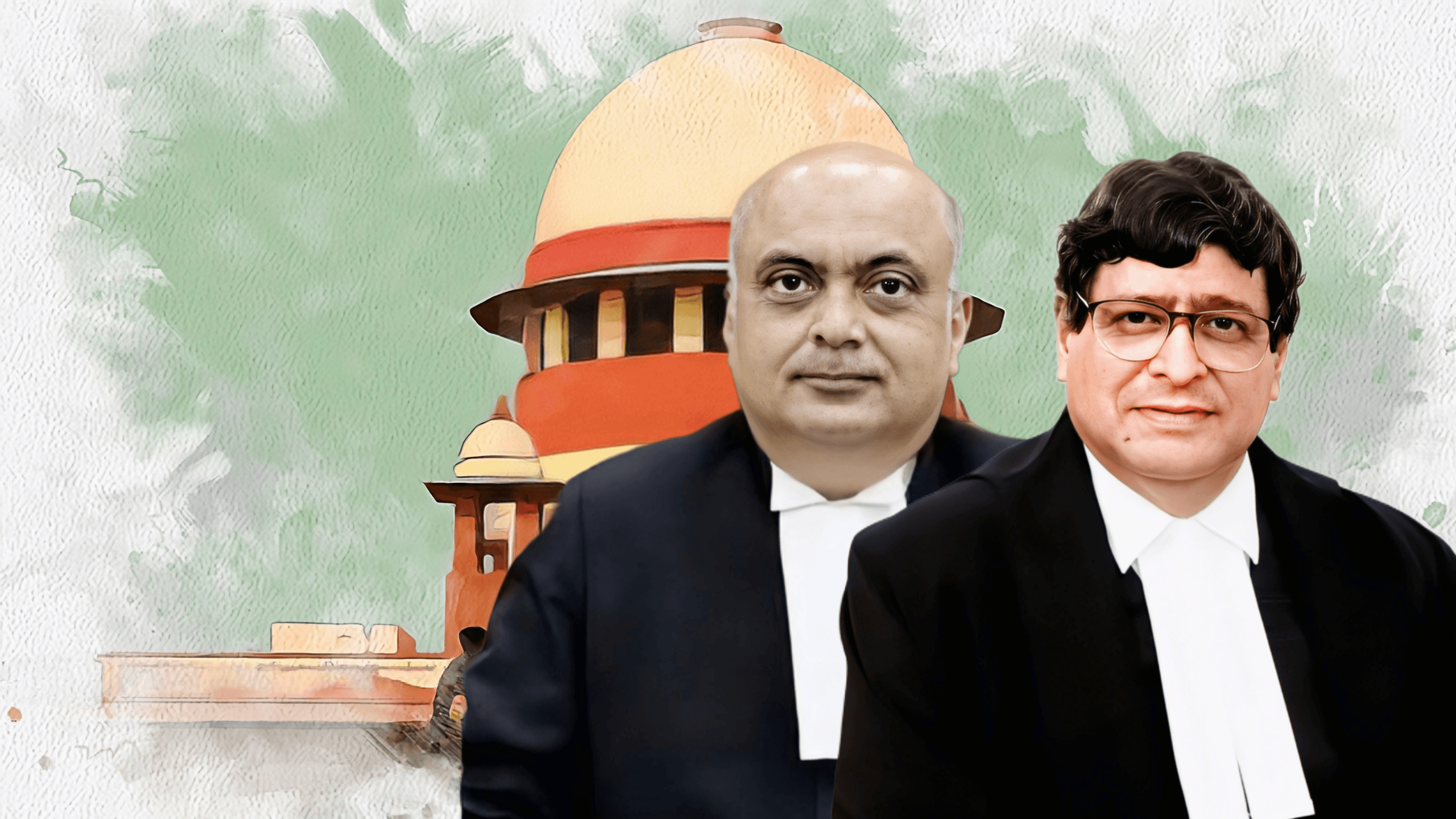

A significant judgment was handed down by the Supreme Court of India on April 7, 2025, in the case of Kuncham Lavanya and Others v. Bajaj Allianz General Insurance Co. Ltd. and Others.

The judgment upheld the right to compensation in a motor accident case in which the High Court had reversed the award due to perceived weaknesses in witness evidence.

Justices Ahsanuddin Amanullah and Sudhanshu Dhulia highlighted that procedural lapses or delays in testimony should not be allowed to overcome the considerable justice that is given to a mourning family, particularly where the grieving family is supported by credible police inquiry and forensic evidence.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

A scooter rider named K. Yadagiri was tragically killed in March 2011 when he was struck by a car that was traveling at an excessive speed. This case revolves on his death.

The claim that was submitted by the family was initially approved by the Motor Accidents Claims Tribunal (MACT), but it was ultimately rejected by the High Court against the health insurance provider.

This verdict was overturned by the Supreme Court, which reinstated the insurance company’s responsibility to abide by the law.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

Historical Context of the Case

K. Yadagiri was riding his Bajaj scooter home on the evening of March 20, 2011, when he was struck from behind by a red Hyundai Verna automobile outside of Taranaka (HUDA Complex), which is located in the state of Telangana.

The injuries he sustained were life-threatening, and he ultimately passed away at Gandhi Hospital. The following day, a First Information Report (FIR) was filed in accordance with Section 304A of the Indian Penal Code, which addresses the act of causing death via negligence.

A compensation claim was submitted to the MACT by the dead individual’s family, which included his widow and children. The family was demanding a sum of ₹23 lakhs. In addition to presenting a variety of documents, they asked three witnesses questions.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

Following the evaluation of the documents and the summoning of the investigating officer as a court witness, the MACT determined that the car owner and the insurance were jointly and severally culpable for the accident. As a result, they gave a compensation amount of ₹33.63 lakhs.

Bajaj Allianz, an insurance firm, filed an appeal with the High Court, which ultimately overturned the decision made by the MACT about the potential liability of the company.

The court came to the conclusion that the claimants had not adequately proven the identify of the vehicle that had committed the offense because of the uncertain credibility of an eyewitness. This gave rise to the appeal that was filed with the Supreme Court.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

For More Updates & Regular Notes Join Our Whats App Group (https://chat.whatsapp.com/DkucckgAEJbCtXwXr2yIt0) and Telegram Group ( https://t.me/legalmaestroeducators )

Concerns That Have Been Presented to the Supreme Court

The most important question that was brought before the Supreme Court was whether or not the High Court made the correct decision when it overturned the order of the MACT simply on the basis of the delay in an eyewitness’s statement.

The court was tasked with determining whether or not the identity of the car that caused the accident had been sufficiently established, as well as whether or not the insurance could still be held accountable despite the fact that there were technical issues regarding the credibility of one witness.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

The appellants maintained that the High Court had made a serious mistake when it dismissed the testimony of PW2, an eyewitness, simply due to a delay of two and a half months in reporting the vehicle’s registration number.

They claimed that this was the sole reason for why the testimony was dismissed. It was their contention that this was supported by an investigation conducted by the police, an additional witness who provided evidence, and a report from a forensic inspection that found damage that was consistent with the accident.

It was argued by the insurance company that PW2 was unreliable, that the registration number had been manufactured, and that the insurance company had failed to identify the driver in the criminal case.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

They asserted that the witness had retained the number on a paper slip for a period of time that was peculiar, and that he had only disclosed it by chance when the police went to his location. In addition, they contended that the car had not sustained enough damage to support the theory that it had been involved in a collision at a high speed.

The Evaluation of the Evidence by the Court

The Supreme Court conducted a thorough examination of the many aspects of the investigation, including the inspection report, the testimony of witnesses, and the procedure sequence.

In the original report, it was noted that the car number was not mentioned, which is not an unusual occurrence in situations involving hit-and-run accidents or accidents that occur at a rapid pace. The objective of a First Information Report (FIR) is not to give definitive identification but rather to launch an investigation.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

Concerning the delay that PW2 had in submitting the registration number, the court noted that his behavior looked to be out of the ordinary.

However, the court decided that it could not automatically discredit the entire claim, particularly when it was supported by other material such as the police charge sheet, the mechanical inspection report of the Verna car showing damage on the front bumper, and the testimony of the investigating officer confirming that the car was involved in the incident.

It was further highlighted by the Court that claims pertaining to automotive accidents are of a civil character, and the Court made its decision based on the principle of preponderance of probability, rather than proof beyond reasonable doubt, which is necessary in criminal proceedings.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

It was determined that if civil courts were compelled to adhere to the same standard of proof as criminal courts, then a significant number of legitimate claimants would be refused compensation in an unfair manner.

Insurance Company’s Responsibility to Pay Claims

In its observation, the Supreme Court noted that the owner of the automobile had totally neglected to appear before the MACT, High Court, or Supreme Court and had not provided any form of defense.

As part of the investigation conducted by the police, the proprietor stated that he was only made aware of the accident when the officers contacted him. After being called by his driver, the driver finally admitted his involvement and turned himself in.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

This behavior, as stated by the Court, provided additional support for the inference that the collision did, in fact, involve the insured car.

Due to the fact that the insurance had not demonstrated any violation of the policy conditions or any fraudulent activity, the court determined that it was not possible for the insurer to avoid culpability simply by throwing doubt on a delayed statement.

In addition, the court made it clear that the insurance company had not demonstrated any purposeful misrepresentation, nor had it provided a more compelling alternative explanation for the accident.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

The Importance of Giving Justice in Practice

When it comes to instances involving accident compensation, the Supreme Court emphasized that the focus should be on practical and humanitarian justice rather than technicalities.

It came to the conclusion that the High Court had failed to adopt a balanced approach because it had given a disproportionate amount of weight to the delay in witness evidence while dismissing other strong indicators of the vehicle’s involvement.

It was brought to the attention of the court that the family of a victim should not be compelled to pursue justice indefinitely simply due to the fact that an eyewitness hesitated or stumbled in his statement.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

Courts are required to recognize the conclusions of a government agency, such as the police, when the agency closes an inquiry that points to a particular car and there is no other evidence presented, unless the results are strongly contradicted.

The Supreme Court’s Opinion on the Matter

Following the approval of the appeal, the Supreme Court reversed the decision of the High Court and reinstated the award that had been handed down by the MACT. It was decided that the insurance company shall continue to be equally and severally liable with the owner of the car in order to pay the compensation that was given to the family of the deceased.

The court also made notice of the fact that its findings were limited to the civil component and would not have any impact on the criminal proceedings that were either underway or had already been resolved.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

Specifically, this ruling serves as a reaffirmation of the role that the judiciary plays in ensuring that victims of motor vehicle accidents receive justice. Additionally, it sheds light on the constraints of placing an excessive amount of dependence on procedural technicalities, which undermines the functionality of welfare laws such as the Motor Vehicles Act.

For the purpose of accident compensation law in India, the judgment that was handed down in the case of Kuncham Lavanya and Others versus Bajaj Allianz General Insurance Co. Ltd. and Others is an important precedent.

This not only defines the evidence bar in civil proceedings that fall within the jurisdiction of the Motor Vehicles Act, but it also emphasizes the significance of substantive justice instead of technical doubts.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

When supported by genuine police findings and mechanical evidence, the verdict ensures that bereaved families are not unfairly denied compensation owing to procedural flaws or witness delays. This is especially true when the ruling is supported by mechanical evidence.

The fact that insurance firms cannot avoid liability on the basis of simple procedural grounds when policy conditions are not violated is another point that is emphasized by this. With this ruling, the courts are reminded that their purpose is to uphold justice, not perfection, and that they are required to adopt a pragmatic perspective based on the specifics of each individual case.

![Research Assistantship @ Sahibnoor Singh Sindhu, [Remote; Stipend of Rs. 7.5k; Dec 2025 & Jan 2026]: Apply by Nov 14, 2025!](https://legalmaestros.com/wp-content/uploads/2025/11/Gemini_Generated_Image_s0k4u6s0k4u6s0k4-768x707.png)

![Karanjawala & Co Hiring Freshers for Legal Counsel [Immediate Joining; Full Time Position in Delhi]: Apply Now!](https://legalmaestros.com/wp-content/uploads/2025/11/Gemini_Generated_Image_52f8mg52f8mg52f8-768x711.png)