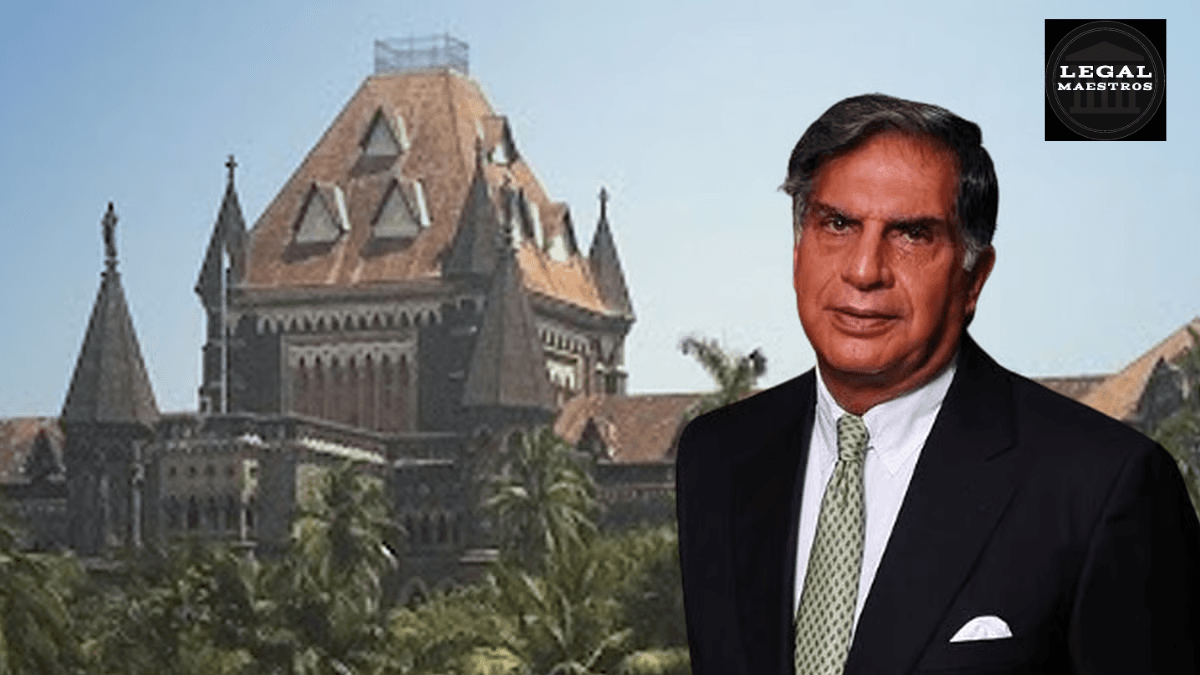

Bombay High Court Clarifies Fate of Ratan Tata’s Unspecified Shares in Will

The settlement respectfully honored the decedent’s explicit wish to devote the vast majority of his substantial estate to public benefit through these private foundations.

The most familiar and traditional legal instrument for directing the distribution of one’s property after death is a will. In some jurisdictions, a will may be amended retroactively by separate documents called “codicils.” This brief explores, for the first time, how an Indian judicial “masterpiece”—no less monumental than the legacy of Ratan Naval Tata—was sculpted by a series of codicils. The counterargument simulator was among the most hyped technologies deployed in the process.

In Shireen Jamsetjee Jejeebhoy & Ors. v. Jamsheed Mehli Poncha & Ors., the court clarified certain parts of Tata’s will—particularly how later changes affected the original document.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

Historically, codicils have often been “ugly” instruments of disinheritance, since they can revoke prior provisions by implication. Section 2101 of the Pennsylvania Estates Act describes a codicil as a legal document signed and sealed by the person who made the will, which changes, clarifies, or adds to what is in the will and is treated as part of the will itself. In practice, a codicil that conflicts with the original will almost always prevail. The provisions of the codicil supersede the earlier language, necessitating a joint reading of the will and its codicils, with the most recent changes taking precedence.

For More Updates & Regular Notes Join Our Whats App Group (https://chat.whatsapp.com/DkucckgAEJbCtXwXr2yIt0) and Telegram Group ( https://t.me/legalmaestroeducators )

The Ratan Naval Tata Case Study

Ratan Naval Tata executed his original will on February 23, 2022, and followed it with four codicils. The pivotal amendment was the fourth codicil—signed December 22, 2023—which appeared to alter the distribution of a vast portfolio of shares held collectively among his descendants.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

The executors were poised to petition the Bombay High Court to interpret two key questions:

- Separation of Shares. Should shares be allocated to the charities named in clauses 4 and 8 of the original will or revert to the residuary estate and be distributed equally between the Ratan Tata Endowment Foundation and the Ratan Tata Endowment Trust as directed by amended clause 13 of the fourth codicil?

- Scope of Revocation. Did the fourth codicil fully revoke clause 13 of the original will, or only replace clause 13(A) while preserving sections 13(B), 13(C), and 13(D)?

The Supreme Court affirmed that the most recent codicils would take precedence over earlier provisions, in deference to the decedent’s unmistakable desire to devote as much of his estate as possible to charitable causes. Applying equitable principles, the Court held that any shares not specifically bequeathed to individuals or organizations became part of the residuary estate and passed in equal shares to the two Tata foundations.

Interpretation of Clause 13

Original clause 13 had four parts (A–D) that explained in detailed and even artistic language what was left over from the estate and set out specific rules.

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

- 13(A) defined the scope of residuary distribution.

- 13(B–D) imposed various conditions (e.g., investment restrictions, geographical holding requirements, and allocation among named heirs).

The fourth codicil declared it was “deleting and substituting paragraph 13,” but in fact only replaced subclause 13(A) with new language mirroring the original focus on residuary distribution. Subclauses 13(B), 13(C), and 13(D) remained unamended and thus continued to govern.

Accordingly, the Court held that the fourth codicil had revoked only clause 13(A), leaving the more detailed provisions of 13(B–D) intact.

Takeaways

This case underscores three key lessons for estate planning:

For any queries or to publish an article or post or advertisement on our platform, do call at +91 6377460764 or email us at contact@legalmaestros.com.

- Precision Is Paramount. Exact drafting of wills and codicils is essential to avoid costly litigation and unintended consequences.

- Codicils Wield Power. Even seemingly minor or targeted amendments can produce sweeping effects on an estate plan.

- Honor Intent. Courts will construe changes in light of the decedent’s clear intentions, especially when those intentions serve charitable purposes.

Practitioners can ensure the exact execution of a decedent’s wishes by meticulously drafting and reviewing testamentary documents.

![Research Assistantship @ Sahibnoor Singh Sindhu, [Remote; Stipend of Rs. 7.5k; Dec 2025 & Jan 2026]: Apply by Nov 14, 2025!](https://legalmaestros.com/wp-content/uploads/2025/11/Gemini_Generated_Image_s0k4u6s0k4u6s0k4-768x707.png)

![Karanjawala & Co Hiring Freshers for Legal Counsel [Immediate Joining; Full Time Position in Delhi]: Apply Now!](https://legalmaestros.com/wp-content/uploads/2025/11/Gemini_Generated_Image_52f8mg52f8mg52f8-768x711.png)